Biotech Startup Valuation: Key Metrics for Funding Rounds

Biotech startup valuation involves assessing a company’s worth using metrics like discounted cash flow, comparable company analysis, and venture capital methods to attract investors and secure funding.

Navigating the complex world of biotech startup valuation can be daunting, especially when seeking funding. Understanding the key metrics is crucial for presenting a compelling case to investors and securing the capital needed to fuel your company’s growth. This article delves into three essential metrics every biotech startup should know before their next funding round.

Biotech Startup Valuation: Why It Matters

Ensuring your biotech startup has a strong valuation significantly impacts your ability to attract investors and secure the necessary funding. A well-justified valuation can enhance investor confidence, leading to better terms and a higher influx of capital.

Furthermore, understanding valuation principles is not just about attracting investments; it’s also about strategic financial planning and making informed decisions about the future of your company.

The Importance of Accuracy

An accurate valuation reflects your company’s current state and future potential. Overvaluing can deter investors, while undervaluing can lead to missed opportunities. Accuracy builds trust and credibility.

Long-Term Financial Health

A solid valuation provides a foundation for long-term financial planning. It aids in forecasting future revenues, managing expenditures, and setting realistic goals for growth and profitability.

Consider these crucial points when thinking about why valuation matters for your biotech startup:

- Investor Confidence: A fair valuation signals a realistic understanding of your company’s prospects.

- Strategic Planning: It helps in setting realistic milestones and financial objectives.

- Negotiation Power: A strong valuation gives you leverage in investment negotiations.

In conclusion, understanding and managing your biotech startup’s valuation is pivotal for attracting investments, fostering investor trust, and laying a solid foundation for sustainable financial growth.

Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) analysis is a fundamental method for determining the present value of expected future cash flows. For biotech startups, this involves projecting revenues from potential products and deducting associated costs, then discounting these cash flows back to their present value using an appropriate discount rate.

DCF is preferred due to its focus on intrinsic value, reflecting the true economic value of the startup based on its future potential in the biotech market.

Projecting Future Cash Flows

Accurate revenue projections are critical for a reliable DCF analysis. This involves forecasting peak sales, market penetration rates, and product pricing strategies. Consider regulatory approvals, patent expirations, and competition.

Determining the Discount Rate

The discount rate reflects the risk associated with the investment. For biotech startups, which are inherently risky due to long development cycles and regulatory uncertainties, the discount rate is typically higher than for established companies.

- Weighing the Risks: Consider clinical trial outcomes, regulatory hurdles, and market competition when determining the discount rate.

- Using WACC: Employ the Weighted Average Cost of Capital (WACC) method to balance the cost of equity and debt.

- Sensitivity Analysis: Perform sensitivity analysis to understand how changes in the discount rate impact the valuation.

The Discounted Cash Flow (DCF) analysis is a critical tool for biotech startups, providing a framework to assess the present value of future cash flows. By focusing on precise revenue predictions, accounting for risks and challenges, and using an appropriate rate of return, biotech firms can derive a more reliable estimate of their intrinsic value using the DCF method.

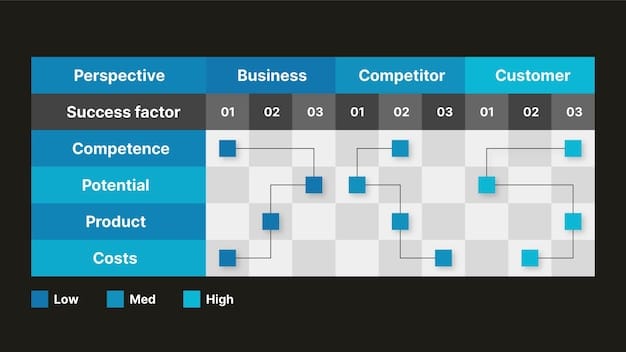

Comparable Company Analysis (CCA)

Comparable Company Analysis (CCA) involves identifying publicly traded companies that are similar to your biotech startup in terms of products, market, and stage of development. Key valuation metrics are then computed by studying the financial ratios and market capitalization of comparable companies to derive an estimate of your startup’s valuation.

CCA is beneficial for providing a market-driven perspective that reflects current investor sentiment and competitive dynamics and adds a different dimension to other methods used to calculate biotech startup valuation.

Identifying Suitable Comparables

Finding truly comparable companies can be challenging. Look for companies with similar therapeutic areas, development stages, and target markets. Consider factors like revenue size, growth rate, and profitability.

Applying Valuation Ratios

Common ratios used in CCA include Price-to-Earnings (P/E), Enterprise Value-to-Sales (EV/Sales), and Price-to-Book (P/B). Apply these ratios to your startup’s financials to estimate its value. Understanding and analyzing the key metrics of companies that are comparable to your biotech startup will provide valuable insights.

Key points for applying value ratios in your CCA:

- Market Multiples Assessment: Assess market multiples from comparable publicly traded firms to determine how investors are valuing similar companies.

- Sector Benchmarks: Consider and compare sector benchmarks for key financial ratios like P/E, EV/Sales, and Price-to-Book.

- Relative Value: Calculate valuation based on comparing your startup to established companies, to identify a competitive edge.

In summary, Comparable Company Analysis (CCA) is a useful tool for biotech startups, delivering market-driven valuation perspectives. By carefully selecting and comparing the financial indicators and strategies of similar publicly traded firms, and by keeping track of sector trends, biotech firms can determine a more market-aligned appraisal of their inherent value through CCA methods.

Venture Capital Method

The venture capital (VC) method estimates a startup’s future exit value and discounts it back to the present using a target rate of return expected by investors. This method is particularly suited to biotech startups, which often have high growth potential and a clear exit strategy, such as an acquisition or IPO, but takes into account the significant risks involved.

The VC method directly aligns with investor expectations, providing a valuation that resonates with potential funders. It’s also beneficial in scenarios where future potential outweighs current performance.

Estimating Future Exit Value

The future exit value is the projected value of the company at the time of a liquidity event, such as an acquisition or IPO. This estimation should be based on realistic assumptions about market conditions, competition, and the company’s growth trajectory.

Determining the Target Rate of Return

Venture capitalists typically expect a high rate of return to compensate for the risk of investing in startups. This rate depends on factors like the stage of the startup, the industry, and the overall economic environment.

Applying the VC Method

The Venture Capital (VC) method provides a practical approach to evaluating value, which makes it essential for biotech companies looking for funding:.

- Calculate Terminal Value: Estimate a future exit value by considering possible future events like acquisitions or IPOs.

- Set Investor ROI: Determine the expected investment return rate that takes into account venture capital risk and benchmarks for the industry.

- Calculate Present Value: Adjust future returns using the anticipated ROI to find the current investment limit.

To conclude, the Venture Capital (VC) method serves as an invaluable tool for biotech startups aiming to secure venture financing. By determining future values, taking investor return expectations into account, and correctly adjusting present values using an anticipated ROI, biotech firms can present a compelling valuation for prospective investors.

Other Factors Influencing Valuation

While the aforementioned metrics provide a quantitative framework, several qualitative factors also significantly influence biotech startup valuation. These include the strength of the management team, the intellectual property portfolio, and the regulatory landscape.

These additional factors provide a holistic perspective, ensuring a more accurate valuation that reflects the startup’s overall potential and risks.

Strength of the Management Team

A strong management team can significantly influence investor confidence and, consequently, the valuation. Investors look for experienced leaders with a proven track record in the biotech industry.

The impact of leadership on valuation:

- Credibility and Track Record: Investors seek experienced leaders with past achievements, especially in biotech.

- Strategic Vision: Effective leadership conveys a clear path and strategic vision that builds investor trust.

- Operational Excellence: Competent operational skills are vital for effectively executing business plans.

Intellectual Property (IP) Portfolio

A robust IP portfolio can provide a competitive advantage and enhance the value of a biotech startup. Patents, trademarks, and trade secrets can protect innovative technologies and prevent competitors from copying them.

Intellectual Property is a determining factor that can influence investor interest and significantly increase a biotech startup’s appeal:

- Patent Strength: Startups with a strong intellectual property portfolio can create significant value that attracts investors.

- Competitive Advantage: Patents help give Biotech firms the edge against competitors and protect innovation.

- Barrier to Entry: Trade secrets and difficult-to-replicate technologies create substantial obstacles for competition.

These factors are crucial in determining how an entrepreneurial biotech firm is valued and should be carefully considered by its management to enhance its attractiveness to strategic stakeholders.

Preparing for the Valuation Process

Being prepared for the biotech valuation process is essential for securing favorable terms and maximizing investment. This involves gathering comprehensive financial data, preparing detailed business plans, and engaging with experienced advisors.

Comprehensive preparation not only streamlines the valuation process but also builds trust and credibility with potential investors.

Gathering Financial Data

Accurate and well-organized financial data is the foundation of a credible valuation. This includes historical financial statements, revenue projections, and expense forecasts.

To prepare, biotech companies should focus on organizing comprehensive information and should also:

- Detailed Records: Compile detailed records of past financial performance, including income statements, balance sheets, and cash flow statements.

- Realistic Projections: Develop well-thought-out, realistic sales forecasts based on thorough market analysis and feasible development goals.

- Scenario Planning: Prepare for multiple business scenarios on financial models, to display the business’ resilience.

Creating a Detailed Business Plan

A comprehensive business plan articulates the company’s vision, strategy, and financial projections. It should include a detailed market analysis, competitive landscape assessment, and clear milestones for achieving key objectives.

Crafting a well-thought-out business plan is crucial for securing investment:

- Executive Summary: Begin with a compelling summary that sells the business idea and summarizes key points of the plan.

- Market Analysis: Provide a thorough examination of the sector and clearly identify the target niche.

- Operational Strategy: Detail the biotech startup’s commercialization activities, from R&D to sales and distribution.

Careful planning and preparation for the valuation process is therefore critical, especially when aiming to secure investment in the biotech sphere.

| Key Point | Brief Description |

|---|---|

| 📈 DCF Analysis | Estimates present value based on projected future cash flows. |

| 🏢 CCA Method | Compares your startup to similar publicly traded companies. |

| 💰 VC Method | Estimates future exit value and discounts it back to present. |

| 🛡️ IP Portfolio | A strong portfolio is crucial for securing funding. |

Frequently Asked Questions (FAQ)

▼

Biotech startup valuation is the process of determining the economic worth of a startup, typically before a funding round or acquisition. It involves assessing assets, future potential, and risks.

▼

Valuation is critical for attracting investors, securing funding, and making strategic financial decisions. A well-justified valuation enhances investor confidence and can result in better funding terms.

▼

DCF analysis estimates the present value of expected future cash flows. Biotech startups use it to project revenues from potential products and discount them to their present value.

▼

CCA involves identifying similar publicly traded companies and using their valuation metrics to derive an estimate of the startup’s value, reflecting market sentiment.

▼

The VC method estimates a startup’s future exit value and discounts this back to the present using the rate of return expected by investors, aligning with investor expectations.

Conclusion

Understanding biotech startup valuation and employing these three key metrics – Discounted Cash Flow (DCF) analysis, Comparable Company Analysis (CCA), and the Venture Capital (VC) method – is essential for any biotech startup seeking funding. These tools, combined with a strong management team and a robust intellectual property portfolio, provide a solid foundation for securing the capital needed to drive innovation and growth.