Credit score improvement advice: quick tips for success

To improve your credit score, consistently pay your bills on time, maintain a credit utilization below 30%, check your credit report regularly, and keep old accounts open for a longer credit history.

Credit score improvement advice is essential for anyone looking to enhance their financial well-being. Whether you’re planning to buy a home or secure a loan, understanding how to boost your credit score can open doors to better opportunities. Ready to learn more? Let’s dive in!

Understanding credit scores and their importance

Understanding your credit score is vital for managing your finances effectively. It impacts your ability to borrow money and the interest rates you may receive. A strong credit score opens up better financial opportunities.

Many people do not realize how their credit score is calculated. Here, we will explore the factors that affect your score so you can be better prepared to improve it.

Key Factors That Influence Your Credit Score

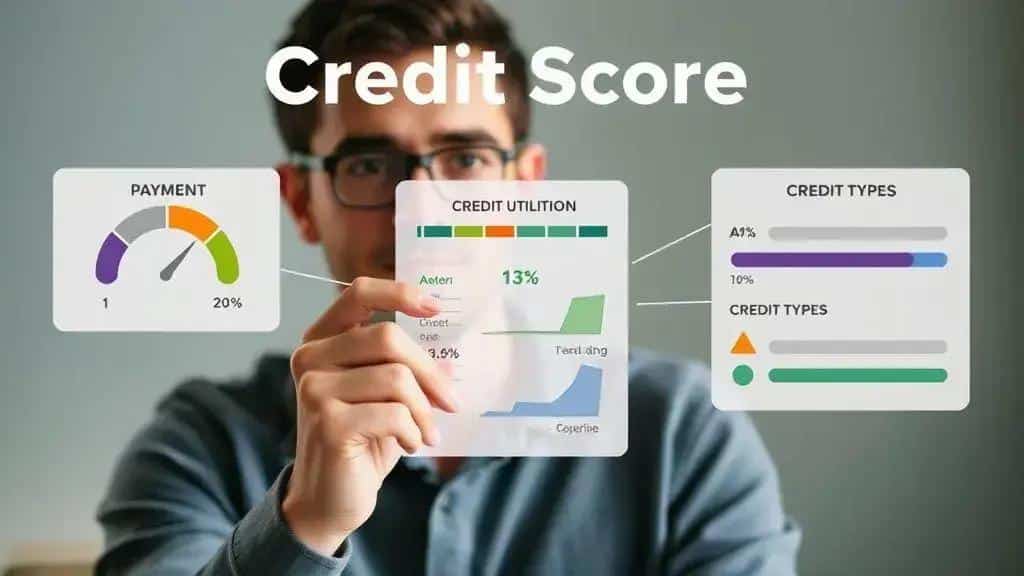

Your credit score is based on various factors, including:

- Payment history: This is the most significant factor. Consistently paying bills on time boosts your score.

- Credit utilization: This refers to the amount of credit you are using compared to your total credit limit. Keeping this below 30% is recommended.

- Length of credit history: A longer credit history typically leads to a higher score.

- Types of credit: Having a mix of different types of credit is beneficial. This includes credit cards, mortgages, and installment loans.

Additionally, regularly checking your credit report for errors is crucial. Mistakes happen, and even a small error can negatively impact your score. You can dispute errors with the credit reporting agency to have them corrected.

Why Credit Scores Matter

Having a good credit score matters for several reasons. First and foremost, it affects loan approval. Lenders look at your score to determine the risk of lending to you. A higher score increases your chances of loan approval.

Moreover, a great credit score usually results in lower interest rates. This can save you a significant amount of money over time on loans and credit cards. It can also influence other financial matters, like renting a home or securing insurance.

Common factors affecting your credit score

Several common factors significantly affect your credit score. Understanding each factor is crucial for anyone seeking to improve their financial health. By being aware of these elements, you can take practical steps to enhance your score.

Payment History

Your payment history is the most significant factor influencing your credit score. Consistently making payments on time is essential. Late payments can cause your score to drop quickly.

Credit Utilization Ratio

Another vital factor is your credit utilization ratio. This ratio refers to the amount of credit you’re using compared to your total available credit. Keeping this ratio below 30% is generally recommended. Doing so shows lenders that you are responsible with credit.

Length of Credit History

The length of your credit history also plays a role in your score. A longer credit history can be favorable, as it provides more data about your credit behavior. If you’re new to credit, it may take time to build a strong history.

Types of Credit

Having a mix of credit types can positively influence your score. This includes credit cards, mortgages, and auto loans. A diverse credit mix can show lenders that you can handle different types of financial responsibilities.

Additionally, new credit inquiries can temporarily lower your score. When you apply for a new credit account, lenders will review your credit report, which can affect your score slightly. Be mindful of how often you apply for new credit.

Lastly, checking your credit report regularly is essential. Ensure there are no errors, as incorrect information can negatively impact your score. You can request free copies of your credit report from the three major reporting agencies annually.

Practical tips to improve your credit score

Improving your credit score might seem challenging, but with some practical tips, you can enhance your financial standing over time. Small changes can have a big impact on your overall score.

Pay Your Bills on Time

One of the simplest and most effective ways to boost your score is to pay your bills on time. Late payments can hurt your score significantly. Set reminders or automate payments to make this easier.

Reduce Your Credit Utilization

Another crucial step is to reduce your credit utilization. Aim to keep this ratio below 30%. You can do this by paying down existing debt or requesting higher credit limits. Both actions can help improve your score.

Become an Authorized User

Consider becoming an authorized user on a family member or friend’s credit card. This can help increase your credit history and potentially improve your score, provided the primary cardholder maintains a good payment history.

Additionally, avoid closing old credit accounts. Keeping them open can help lengthen your credit history, which is beneficial for your score. A longer credit history typically reflects positively on lenders.

Check Your Credit Report Regularly

It’s also important to check your credit report regularly for errors. You can request one free report per year from each of the three major credit bureaus. If you find any inaccuracies, dispute them immediately.

Lastly, limit the number of credit inquiries. When you apply for new credit, it can result in a hard inquiry, which may lower your score temporarily. Space out your applications to minimize the impact.

How to maintain a good credit score over time

Maintaining a good credit score over time is essential for your financial health. It’s not just about improving your score; it’s about keeping it in good standing. With the right practices, you can achieve this.

Establish Consistent Payment Habits

One key to maintaining your score is to establish consistent payment habits. Always aim to pay your bills on or before their due dates. This will help you avoid late payments, which can negatively impact your score.

Monitor Your Credit Utilization

Aim to keep your credit utilization below 30%. This means using only a small portion of your available credit. If you find yourself nearing this limit, consider paying down your balances or increasing your credit limits.

Keep Old Accounts Open

Another important aspect is to keep your old credit accounts open. Lengthening your credit history can positively impact your score. Even if you don’t use these accounts regularly, they can still provide valuable history.

Regularly checking your credit report is also crucial. This can help you identify mistakes or inaccuracies that need corrections. You are entitled to a free report once a year from major credit bureaus. Make sure to take advantage of this.

Limit New Credit Requests

While it may be tempting to apply for new credit, it’s important to limit how frequently you do so. Each application can create a hard inquiry on your report, which may lower your score temporarily. Space out any new credit requests.

In conclusion, these practices will help you maintain a good credit score over time. Staying informed and proactive about your financial habits is key to long-term success.

FAQ – Frequently Asked Questions about Maintaining a Good Credit Score

How often should I check my credit report?

You should check your credit report at least once a year to ensure all information is accurate and to identify any potential issues.

What if I find an error on my credit report?

If you find an error, you can dispute it with the credit reporting agency. They are required by law to investigate your claim.

Does closing old credit accounts hurt my credit score?

Yes, closing old accounts can negatively impact your credit score by reducing your credit history and increasing your credit utilization ratio.

Can applying for new credit affect my score?

Yes, applying for new credit can lower your score temporarily due to hard inquiries on your credit report.